People Helping People

Originally published in Forbes & Fortune, this article exemplifies the values of Coastal1.

“Consistency is what allows institutions like ours to stand the test of time,” says Brian Azar, president and CEO of Coastal1 Credit Union. “We were founded on the principle of ‘people helping people,’ and that philosophy has guided us for nearly a century.”

Founded in 1928, Coastal1 has grown considerably from its humble origins as the Pawtucket Credit Union. Today, the credit union serves more than 140,000 members across Rhode Island and southeastern Massachusetts, overseeing $3.3 billion in assets.

Founded in 1928, Coastal1 has grown considerably from its humble origins as the Pawtucket Credit Union. Today, the credit union serves more than 140,000 members across Rhode Island and southeastern Massachusetts, overseeing $3.3 billion in assets.

Much like a bank, Coastal1 provides members with a wide range of personal financial services, from checking accounts to home loans. Unlike a bank, however, Coastal1 is a not-for-profit financial cooperative owned entirely by its members.

Our members want to be treated fairly, and they want to work with people they can trust,

When the credit union turns a profit, that money is returned to members in the form of better rates on deposits and loans, reduced fees, and higher-quality services. This allows the credit union to focus less on making money and more on providing an exceptional member experience.

“Our members value excellent service, particularly in-person service, which is increasingly difficult to find.”

The Value of Service

Exceptional customer service doesn’t happen by accident, Azar notes. It’s the result of ongoing investments in hiring and training. It’s also a significant expense, which is why the for-profit banking industry has focused on self-service technology. While reduced staffing costs might be great for those shareholders’ earnings, it’s not so great for the customer experience.

“When you cut staff, you’re also removing the people that your members have grown to like and trust,” Azar says. “That consistency of staff really matters. Our average branch management team averages a dozen years of experience. These relationships take years to build, and they have real value to our members.”

Trusted relationships have also allowed the credit union to expand its member services into new areas, such as insurance services and wealth management.

“We want to provide the financial services that our members need, no matter what stage of life they are in,” Azar says. “Many of our members are nearing retirement age, and they are looking for help as they plan their futures. We’re able to bring in trusted partners to provide that service for them. It allows us to be a one-stop financial planning shop for our members.”

Business Banking

Another way that Coastal1 serves members and their communities is by supporting local businesses. Many large and regional banks no longer provide the smaller commercial loans that these local companies rely on, as they tend to be much less profitable. This has made it difficult for local businesses to get small loans for things like vehicles and equipment, even with healthy balance sheets and excellent credit.

“Many of our members own small businesses, and over the past several years we have been looking at ways to better serve them,” Azar says. “It helps these businesses grow, which is great for the communities they serve. It’s also good for us, because it allows us to diversify our portfolio and improve our overall financial health.”

In addition to providing business customers with essential banking services and loans, the credit union offers a suite of merchant services, from payment processing to fraud prevention. With online fraud steadily increasing, business owners want to know that their accounts are safe. If there’s a problem, those customers also want to know that they can count on receiving exceptional personal service.

These are the types of things that really matter to our business customers.

We’re able to deliver products and services of different levels of sophistication for different sizes and types of businesses. This means that our business customers can spend more time growing and building and less time futzing around with their banking.

Balancing Technology and Service

One of the reasons that Coastal1 is able to provide members with an exceptional quality of service is the credit union’s thoughtful integration of new technology. These upgrades tend to happen behind the scenes, with processes and systems being carefully upgraded to minimize the impact on less technically inclined members.

“Most people wouldn’t notice these changes,” Azar says. “They might notice small things, however, like the fact that we’re now able to issue debit cards instantly in branch at account opening. We have access to a lot of technology, but we’re slow to adopt it because we want to make sure that it actually makes things more efficient for our members and staff.”

Providing exceptional in-person service also doesn’t have to come at the cost of technological innovation. In fact, Coastal1 provides the same range of online and mobile solutions offered by most banks, including Zelle. Members can easily manage their accounts online and get assistance from the credit union’s contact center. For many members, however, there simply is no online equivalent for the in-person experience.

“Our members matter to us,” Azar says. “We’re here to address their needs and treat them like people instead of account numbers. When they have a question about a service or a problem with their account, they often don’t want to navigate a phone menu or deal with a chatbot. They want to have a face-to-face conversation with someone they trust.”

Culture and Community

Another important factor in Coastal1’s success is its strong internal culture of inclusion, trust, and respect. It’s truly a team atmosphere, Azar notes, with staff eagerly working to support each other. Not surprisingly, Coastal1 has been repeatedly named as one of the Best Places to Work by Providence Business News.

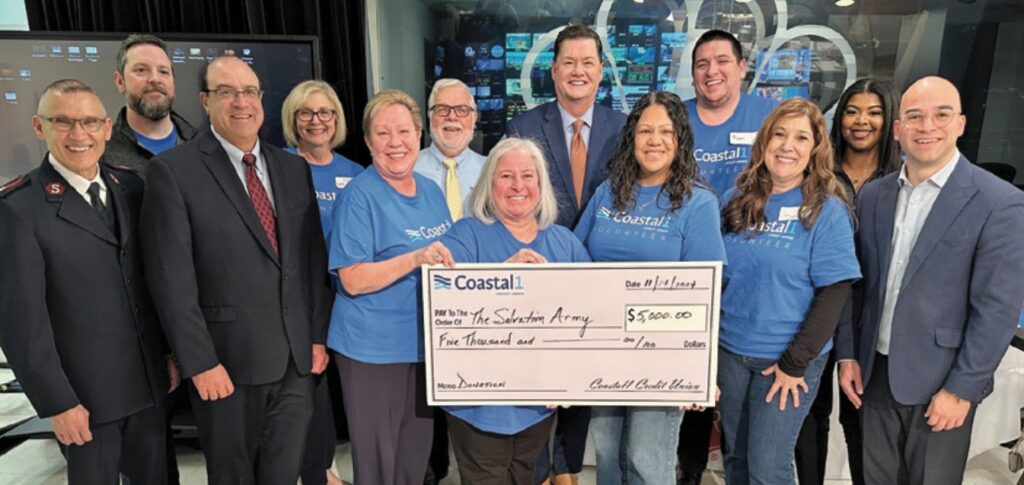

“We’re also very connected to the communities that we serve,” Azar says. “We provide support to these communities in any way we can, including donating our time, talent, and money to local causes. In 2024, for example, we contributed a little over $450,000 to local nonprofit and charitable organizations.”

“We’re also very connected to the communities that we serve,” Azar says. “We provide support to these communities in any way we can, including donating our time, talent, and money to local causes. In 2024, for example, we contributed a little over $450,000 to local nonprofit and charitable organizations.”

The credit union donates hundreds of volunteer hours to community organizations and projects each year, including a long-standing relationship with the Special Olympics Rhode Island. The organization also supports a wealth of small community projects, such as Pawtucket Proud Day, where organizations spend the day cleaning up local parks and greenspaces.

It’s great for the community, and it’s also good for our internal culture. It doesn’t matter if you’re a teller or a VP when you’re working together to fill backpacks for the coming school year for kids in need.